AI search presents ‘existential’ challenge to publishers

The rise of generative-AI search is creating an “existential crisis” for publishers reliant on referral traffic for audience development, according to industry leaders.

“The modern internet has been built on the ad model being the incentive for us to create persistent environments on the internet,” Natasha Wallace, global chief strategy officer at Brandtech Group agency Jellyfish, told The Media Leader.

What happens if that model falls apart and publishers can no longer monetise audiences finding their content via search?

Wallace continued: “That does open up [the question]: what is the reason why we would produce content and what is that monetisation model? That is the big challenge that a lot of publishers need to face.”

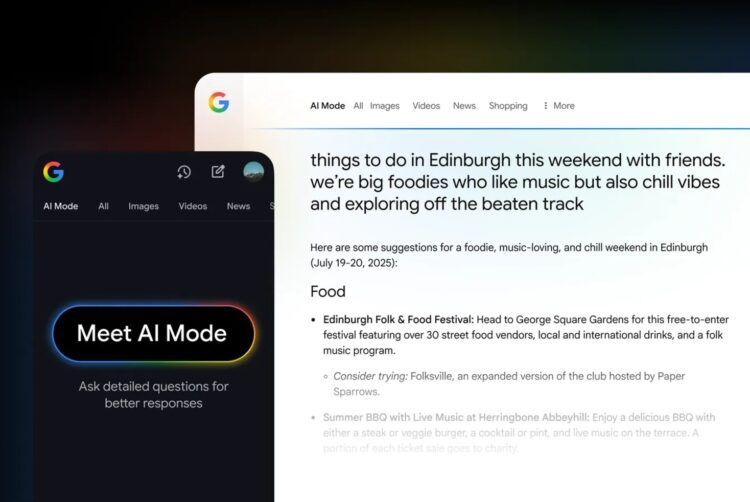

At the end of the July, Google rolled out AI Mode in the UK, a new search experience that allows users to have conversations with a chatbot about topics of interest. The feature is part of Google’s intent to move from a search engine to an “answer engine” — an effort that began with last year’s launch of AI Overviews in response to the rising popularity of generative-AI chatbots.

The move away from traditional search has had significant downstream effects on publishers, many of which have seen sharp, sudden decreases in referral traffic from search.

Last month, Authoritas, an SEO analytics company, found publishers experience an average 47.5% decline in click-through rates on desktop and 37.7% on mobile when Google’s AI Overviews are served to users. Authoritas also found that a site previously ranked first in a search result could lose four-fifths of its traffic for the relevant query if the results were delivered below an AI Overview.

The impact has also been felt by brands, which have reported similarly large declines in referral traffic to their websites. Will Hanmer-Lloyd, head of Behave and strategy at independent agency Mediaplus UK, said clients have recently seen up to a 30% drop in organic traffic to their websites.

Despite this, Google has repeatedly insisted that such figures are inaccurate, albeit without providing direct evidence to the contrary. In a blog post earlier this month, head of Google search Liz Reid claimed: “Overall, total organic click volume from Google search to websites has been relatively stable year over year.”

She added that “average click quality has increased and we’re actually sending slightly more quality clicks to websites than a year ago”. Reid is defining “quality clicks” as “those where users don’t quickly click back”, although it’s not clear how this differs from engagement rate or at what point a click meets the threshold for “quality” status.

Reid claimed that third-party reports on referral traffic “inaccurately suggest dramatic declines in aggregate traffic — often based on flawed methodologies, isolated examples or traffic changes that occurred prior to the roll-out of AI features in search”.

‘Scary place to be’

Nevertheless, Jamie Credland, CEO of World Media Group, argued that the impact AI Mode is having on publishers in terms of a decrease in traffic is well-documented and presents a severe challenge for any publisher that has not already diversified their business model away from advertising.

“It’s worth noting that there is no way to ‘opt out’ of this functionality without also blocking your site from Google search results entirely, so it represents a significant change to the balance of economic incentives between Google and publishers,” he explained. “And, as far as I can tell, a change made unilaterally by Google.”

Any loss of traffic places publishers’ ad revenue at risk at a time when they are already fighting negative advertiser sentiment over perceived brand-safety risks that have been shown not to actually exist.

Although AI models are reliant on trustworthy information — in part produced by premium news outlets — publishers are in a no-win situation: it is wise to retain visibility in AI search so users remain aware of and exposed to their brand, but there’s no longer any way for them to monetise that exposure if users refrain from clicking links.

Such concerns prompted the Independent Publishers Alliance, non-profit Foxglove and campaign group Movement for an Open Web to file a legal complaint with the UK Competition & Markets Authority, asking the regulator to urgently prevent Google from “stealing the work of British journalists”.

Jonathan Verrall, Jellyfish’s vice-president of SEO, told The Media Leader that the new era of search will mean publishers’ digital ad revenues are “never going to hit the same levels of revenue as publishers had previously realised”.

“The revenue streams from these informational engines is just forever deteriorating,” he added, noting that AI companies presently “have pretty much all the power” in relation to publishers: “For publishers, it’s got to be a scary place to be.”

Brands impacted too

It’s not just publishers that are seeing their digital world upended by AI search. Brands, which have spent the better part of the last three decades investing in SEO with the aim of bringing users to their own websites for product discovery and purchase, are now also having to pivot.

As Credland noted: “Any advertiser with a marketing strategy based on using branded content or thought leadership as a lead generation tool, to drive users to their site, will be negatively impacted by the decline in clicks from the search page.”

To achieve visibility in AI search results, marketers will need to adopt content strategies that seed their brands into sources that various AI models tend to preference when pulling information.

This likely includes premium publishers, but also large social media platforms like Facebook, Instagram, X and Reddit. But “clients are a bit blind” at the present, according to Hanmer-Lloyd.

“From my understanding, AI tools have a real difficulty in understanding what is quality information and what’s not,” he warned. “So it’s partly about the amount you can get out there. In publications, yes, but also places like Reddit.”

That could result in new standards for online marketing strategies, from spending more with publishers and platforms to giving PR teams a more prominent place in communications strategies, working in tandem with generative engine optimisation talent.

On the other hand, Esme Robinson, director of platform solutions and enablement at Publicis Groupe data division Epsilon, told The Media Leader that a changed search landscape need not be cause for ripping up an entire marketing strategy.

“It’s crucial to remember search is just one touchpoint in a much wider consumer journey,” she said. “Email, in-store experiences, social interactions and app connections still play vital roles in keeping brands top of mind and building long-term loyalty.”

Just as publishers have been working on building first-party data strategies through subscriptions and memberships, brands should be investing in first-party data to “insulate against fluctuating organic traffic”, Robinson added. Loyalty schemes, she suggested, will become increasingly central, giving retailers an advantage.

Diversification needed

Piling on to the concerns raised by publishers and brands is the lack of transparency over how their sites are being indexed by AI search platforms.

The Media Leader understands that Google and AI platforms like ChatGPT have yet to grant publishers and advertisers the ability to see how they are showing up in results, prompting agencies like Jellyfish and Havas Media Network to attempt to fill the gap.

According to Verrall’s recent analysis, the changes to search have led to a “great decoupling” between impressions and clicks, with impressions growing even as clicks decline.

He noted that AI companies will eventually get around to “building a way of measuring their impact” when they look to monetise their platforms, presumably with ad revenue. This has yet to occur as the platforms focus on acquiring users.

But even with greater visibility, publishers will need to develop new business strategies, if they haven’t already.

“I think publishers have known for some time now that building their own ecosystem and ensuring that consumers go directly to their platform for news, versus search, is essential,” said Verrall.

Credland agreed, arguing that publishers in the “best position to adjust” are those that “act as a destination for users” and have already developed multiple revenue streams, be it via subscription, membership, podcasts, newsletters, commerce or events.

“For many readers, news content is not simply about answering a specific query but about enjoying quality journalism, opinion pieces, photography, interviews and profiles. AI Mode does nothing to replicate that experience,” Credland added.

Still, he was clear-eyed that there aren’t “any publishers that won’t be negatively affected to some extent”.

Verrall advised publishers to “race to get your content indexed quickly” by AI models so they are included in answers to news-related queries. This would at least give news brands visibility to consumers — a sort of upper-funnel brand strategy. At the same time, publishers could work out revenue-sharing agreements with AI companies.

But what is disconcerting is the lack of uniformed action taken by publishers, with some cutting deals while others sue for copyright infringement.

“For this kind of movement to work, all publishers need to adopt the same stance and send a signal to AI companies that you can’t use our content. And if you do, you’re going to have to pay for it [with a revenue share],” Verrall said.

Search no longer ‘dominated’ by Google

According to Hanmer-Lloyd, while AI Mode presents a substantial shift for Google’s search strategy, the search market was already being upended by social platforms and changing consumer behaviour.

TikTok, for example, has been used by Gen Z and Gen Alpha for many years as a de facto search engine for a variety of queries. Reddit, similarly, has long been used as a form of aggregation of consumer experience.

“Search behaviour is just not going to be so dominated by Google any more,” Hanmer-Lloyd pointed out.

Notably, Behave has seen divergent user behaviour dependent on which AI model an individual is interacting with. Apps like ChatGPT or Perplexity are being used for long conversations, while Google’s AI Mode, as well as Meta’s Llama chatbots and X’s Grok, are currently being used more for top-line, quick hits of information.

“When you go to Google, you are quite often looking for a piece of information or for a direct link to a site. When people go to ChatGPT, they’re often looking for answers to philosophical questions or step-by-step recipes — things like that,” Hanmer-Lloyd explained.

He added that ChatGPT and Perplexity are also unique in that they are currently “designed to be addictive” by giving positive reinforcement to users, such as complimenting their curiosity or the way they phrase questions. Google’s AI chatbots for the moment aren’t designed to be conversational in the same way, leading to shorter conversations.

“Where [consumers] are looking for quick information, the AI will work well,” he posits. “What it’s eating into is the people that were going to be on your site for 20 seconds. It’s not eating up the people that are going to have a long read, fill in information about themselves, anything like that. It’s the shallower end of it.”

Such a suggestion would align with Google’s concept of a “quality click”, but given the diversity of search options, publishers may be wise to move beyond Google in search of audience growth, anyway.

“Most of the big publishers traffic is in-app or not coming through search,” Hanmer-Lloyd noted. As such, new readers can and are being found through alternative modes.

The caveat, of course, is success becomes even more dependent on the strength of a given publishing brand.

“You might need to work out how to build a loyal audience base,” he added.

Also published in: The Media Leader